Money 4 6 – Personal Accounting App

Tracking cashflow and finances is essential for small businesses, but this task doesn’t need to be relegated to the office, or reserved for the company’s bookkeeper. Thanks to cloud computing, these six bookkeeping apps sync seamlessly across desktop, phone, and tablet, allowing you to manage billing, accounting, budgeting, and invoicing on the go.

We reviewed the six best finance apps for small business to help you decide which one will meet the needs of your business.

1. Xero

With their tagline of “beautiful accounting software,” it’s no wonder that users praise Xero’s attractive, simple and clean interface. The app provides a view of cashflow, the ability to reconcile transactions, add expenses, and create and send invoices.

Pros of the Xero App

Personal Capital is one of the best personal finance apps on the market. The service's free budgeting tool allows you to track income, spending, and saving over time. It then breaks down your spending habits into categories, allowing you to view transactions by date, merchant, or vendor so you can analyze each purchase. Select a personal finance app. There are a multitude of personal-finance apps available both for mobile phones and web browsers that offer services to track, tabulate, and analyze your expenses. These apps also offer a range of comprehensiveness, from simply acting as a budget-creation tool to displaying all your assets in one place.

- Invoice feature allows you to create and send invoices and track their status.

- Ability to connect to your bank account so you can see all of your transactions.

- Payments for invoices are synched through your bank account, making accounting one step easier.

- Integrates with more than 350 other business apps.

- Allows unlimited users.

- Free 24-hour support.

Cons of the Xero App

- Not all features from the full site are available; limited functionality monitoring bank accounts, creating and managing invoices, and managing contacts.

- There are no automated features, like overdue alerts or receipts of payment.

- Once your contacts have been added, you can’t edit their information. You’re also limited to just inputting their name.

- Auto-correct doesn’t work in the app.

- There’s no landscape screen rotation.

The Xero app is available for Android, iPad, and iPhone. The app is free to download, but after a 30-day trial, there’s a monthly fee for using Xero’s service, starting at $9 per month. The standard plan is $30 per month, and the premium plan is $70 monthly.

2. inDinero

Most comparable to the Mint personal budgeting app, the inDinero app provides a central hub for all business accounts and credit cards. Use the app to record and categorize expenses, get alerts from various accounts, and see the current status of all your accounts.

Pros of the inDinero App

- inDinero understands that not everyone is accounting inclined, so data is presented in colored graphs and analytics to help you understand how your business is performing.

- You can skip inputting some of your financials, as the app pulls info from your bank statements, credit cards, and even PayPal payments.

- There are alert functions for any unusual activity.

Cons of the inDinero App

- inDinero is more of an analytical tool, so if you’re looking for more in-depth accounting features like specific budgeting and spending capabilities, you will need to look elsewhere.

- User-defined labels will need to be created so there aren’t issues like double entries, but categorizing every transaction can be trying.

- Most users will need to upgrade to the priced services to cover their volume of monthly transactions.

InDinero’s app is available only for iPhone and iPad; there’s no Android option. The app is free to download, and for fewer than 50 transactions per month, inDinero’s service is free. For $29.95 a month, 500 transactions can be tracked, and for a monthly fee of $99.95, there is unlimited tracking.

3. EasyBooks

EasyBooks tries to keep it simple for beginners; for each section of the site, there’s a help section that guides you through initial set-up, explaining terms and functionality. Pay for additional features a la carte-if you want to invoice from within the app, for instance, you can purchase the functionality.

Pros of the EasyBooks App

- Generates a variety of reports, including financials (Profit and Loss Statement, Balance Sheet), customer reports (Customer Aged Debt), or even product inventory reports (Stock Report).

- Ability to compare your figures against previous years to track your business’s growth.

- You can customize everything with your logo, contact information, terms, and so on.

- There’s a built-in search tool to assist you in finding what you’re looking for.

Cons of the EasyBooks App

- No ability to import data.

- Compared to other apps, the design is fairly flat; there’s no color or creative design to the app.

- Features purchased for the app version of EasyBooks will need to be separately purchased for the desktop version.

EasyBooks is available for download for iPhone and iPad users; it’s not available for Android. EasyBooks service is free, as is the app. However, there’s a charge for premium features in the app. EasyBooks charges separately for app and desktop features: for the iPhone/iPad app, getting unlimited transactions costs $39.99; invoicing costs $32.99; and time-tracking costs $12.99.

4. QuickBooks Online

Created by Intuit, QuickBooks is one of the most widely used accounting software systems out there, and has won many awards, including the 2013 CPA Practice Adviser Innovation Award. The app offers easy onboarding for new users, but existing users of the online platform have expressed frustration at the app’s missing features.

Pros of the QuickBooks App

- After selecting your business type, the app customizes your dashboard to your industry.

- Simplifies double-entry accounting via attractive charts, colors and design. This layout also makes it easy to see what areas need attention.

- Ability to automate invoices, payments, expenses, and more.

- There are 150-plus additional business app plug-ins to synch with, such as payment processors or customer relationship management (CRM).

Cons of the QuickBooks App

- If you grant your employees access to your QuickBooks Online account, they may be able to see more information than they should be allowed, like a coworker’s billing rate.

- Quickbooks Online doesn’t offer the full feature set of the site, so you’ll need to upgrade your account to access the additional features.

- Only Intuit payment services can be used.

- Users complain about customer service, and wish the app had an e-mail support center.

QuickBooks Online is available for both Android and iPhone/iPad. Downloading the app is free, but after a 30-day trial, there’s a $9.99 monthly subscription fee.

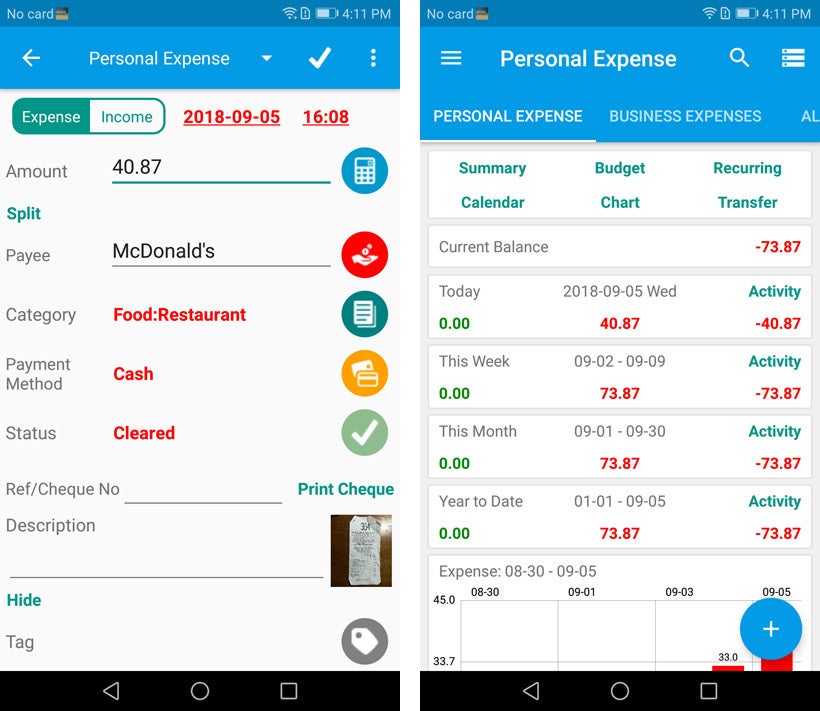

Money 4 6 – Personal Accounting Approaches

5. Kashoo Cloud Accounting

Free Personal Accounting Apps

Kashoo markets itself on simplicity, and perhaps that’s why it is the most downloaded accounting app from the Apple App Store. New users have access to a tour showing off the app’s features for a sample business. View the year’s income and expenses in attractive graphs.

Pros of the Kashoo App

- Offers at-a-glance views into the overall business, including invoicing and expenses.

- Light, attractive, and beginner-friendly with videos to help guide you.

- Several helpful reports, all designed to be legible and conveniently sized within the app.

- Syncs information from all banks and financial accounts.

Cons of the Kashoo App

- Cannot track time or items, like client projects.

- Can’t categorize transactions.

- Some dead-end screens, creating navigation issues requiring extra clicking.

- Does not offer the full functionality of other accounting apps.

- Many complaints that the app is overpriced, as the free version has extremely limited functionality.

Kashoo is available for iPhone/iPad and web only; after a free 30-day trial, the software costs $5 for a solo subscription or $20 for a business per month.

6. Mint

You’ve probably heard of Mint, the popular personal finance app, but it shouldn’t be overlooked that this app can also assist small business owners.

Pros of the Mint App

- Mint is a great app to help simplify and organize your business’s books, helping you to stay on top of your spending with goal setting, tracking, and budgeting.

- Categorization of expenses is simplified, with the ability to either choose from a plethora of expense categories, or create your own.

- Synching financial information across banks accounts and credit cards.

- An expense timeline and notifications for upcoming or late payments help keep you up-to-date.

Cons of the Mint App

- No invoicing ability.

- Customers are assisted through a community forum or via email, rather than over the phone or live support, which can slow down communication.

Mint is available for both Android and iPhone/iPad, and is free to download.